![]()

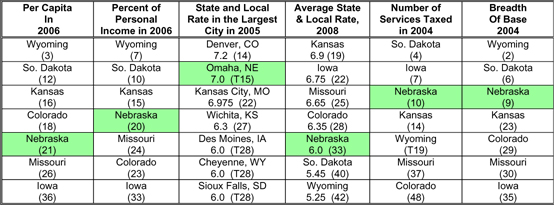

GENERAL SALES TAX RANKINGS

Columns 1 and 2: U.S. Bureau of the Census, State and Local Collections (2006) as calculated and ranked by the Legislative Fiscal Office.

Column 3: 2005 Tax Rates & Burdens, Department of Finance, District of Columbia.

Column 4: Sales Tax Clearinghouse, Inc.; 2008.

Column 5: Federation of Tax Administrators, Survey of Tax Administrators, 2004.

Column

6: Revenue per 1% rate ÷ personal income

reported by John Mikesell, Indiana University,

reported in State Tax

Notes Nov. 28,

2005.

In recent years, Nebraska has become a high sales tax state. In fact in 2004, for the first time, Nebraska ranked higher in sales tax burden than property tax burden. When the Legislature raised taxes to balance the enacted budget in 2002 and 2003, it both expanded the base by eliminating exemptions and adding a few services, and increased the rate from 5% to 5.5%. Except for a repeal of the tax on construction labor, these tax increases have remained intact. The information from the first two columns is taken from 2006 Census Bureau data. The state and local rate in the largest city tends to show the rate that the most residents pay while the average rate combines experiences from across each state. Sometimes the highest local rates are collected in tourist areas where much of the burden is exported to outsiders, and the effects on most residents are small. Nebraska was ranked 10th in the number of services taxed according to a survey conducted by the Federation of Tax Administrators for 2004. The passage of LB 1085 (2002) and LB 759 (2003) added 27 services, increasing our number from 49 to 76 in two years. These changes increased Nebraska's rank by 15 places. It is worthwhile to note that recent fiscal difficulties for all states caused a few states to expand the number of services subject to the sales tax. However, far more responded by increasing the sales tax rate. The last column shows another way to represent the breadth of the Nebraska sales tax base. The measure takes total state sales tax receipts and divides it by the rate to determine the yield of the tax per one percent. This result is then divided by 1% of the state's personal income. In this way the measure produces a rough estimate of the percentage or share of the state's economy that the sales tax reaches. By this measure, Nebraska's sales tax is the 9th broadest of the 50 states and the District of Columbia. The contrast

with Iowa is interesting. According to the 2004 FTA survey, Iowa

taxes more services than Nebraska, yet according to

the breadth of base measure, the base is much narrower. Apparently,

Iowa exempts more goods from tax, for example food and business

inputs, while taxing more services. |