![]()

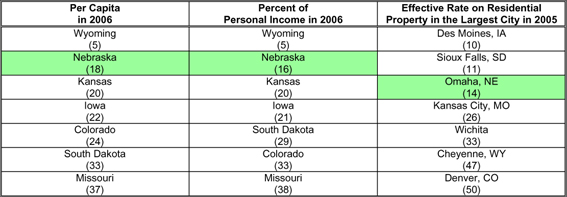

PROPERTY TAX RANKINGS

Columns 1 and 2: U.S. Bureau of the Census, State and Local Collections (2006) as calculated and ranked by the Legislative Fiscal Office.

Column

3: 2005 Tax Rates & Burdens, Department of Finance, District

of Columbia.

By all measures, Nebraska has always been a high property tax state. Based on 2006 census data, we were ranked 18th and 16th highest per capita and as a percent of personal income, respectively. That places Nebraska near the top third nationally and the top half regionally. Our ranking is even higher (14th) when examining the D.C. Tax Burden study and its analysis of residential property tax rates. While Nebraska is a long way from being a low property tax state, these relative burdens are nearer the middle than they have been historically. Levy limits and increased state aid for local governments in the mid to late 1990s have significantly reduced Nebraska's dependence on the property tax for financing public services.

These rankings also help demonstrate one of the shortcomings to utilizing rankings in order to set tax policy. There are simply too many uncontrollable factors that affect these various measures. For example, as a percent of personal income or on a per capita basis, Wyoming appears to be a very high property tax state – the highest in the region. However, the effective tax rate on residential property is nearly the lowest in the country. How is this possible

Much of Wyoming's

property taxes are levied on coal and other mineral wealth in the

state. Wyoming's constitution allows classification and different

treatment of different types of property, so the state imposes its

highest assessment ratio on its mineral resources. In this way, much

of the property tax burden in Wyoming is exported to other parts

of the country. This allows the state to levy a lot of property taxes

without levying high rates on residential property. Because

of this, the