![]()

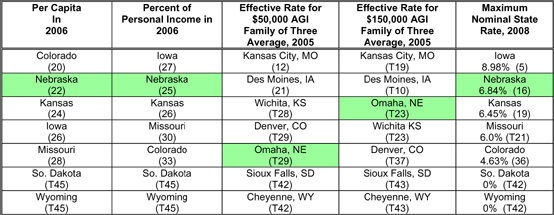

INDIVIDUAL INCOME TAX RANKINGS

Columns 1 and 2: U.S. Bureau of the Census, State and Local Collections (2006) as calculated and ranked by the Legislative Fiscal Office.

Columns 3 and 4: 2005 Tax Rates & Burdens, Dept. of Finance, District of Columbia.

Column

5: Federation of Tax Administrators, January 2008, www.taxadmin.org.

| Overall, Nebraska is a moderately-ranked income tax state. Of the 41 states with an individual income tax, the state ranks in the bottom half in overall burden. Nebraska does not fare as well regionally and two of our neighbors, South Dakota and Wyoming, do not levy an individual income tax at all. Comparison of the last three columns demonstrates the progressivity of the Nebraska income tax. At the $50,000 adjusted gross income level, our effective rate was tied for 29th in 2005, while at the $150,000 level Nebraska passed six states to rank 23rd. Nebraska's top individual income tax rate in 2008 was 6.84%, 16th highest in the nation that year. |